Wales is known for its lush landscapes and picturesque scenery, but this beauty often comes with a price – unpredictable weather. From heavy rainfall and flooding to windstorms and hail, the weather in Wales can cause significant property damage, leading to a high frequency of insurance claims. Understanding how these weather patterns affect property insurance can help Welsh homeowners better prepare and protect their investments.

While contributing to its scenic beauty, Wales’s unpredictable weather poses significant challenges for homeowners. Heavy rainfall, flooding, windstorms, and occasional snow, ice, and hail cause substantial property damage. These patterns lead to frequent property insurance claims, underscoring the importance of proactive measures and appropriate insurance coverage.

Key Weather Impacts:

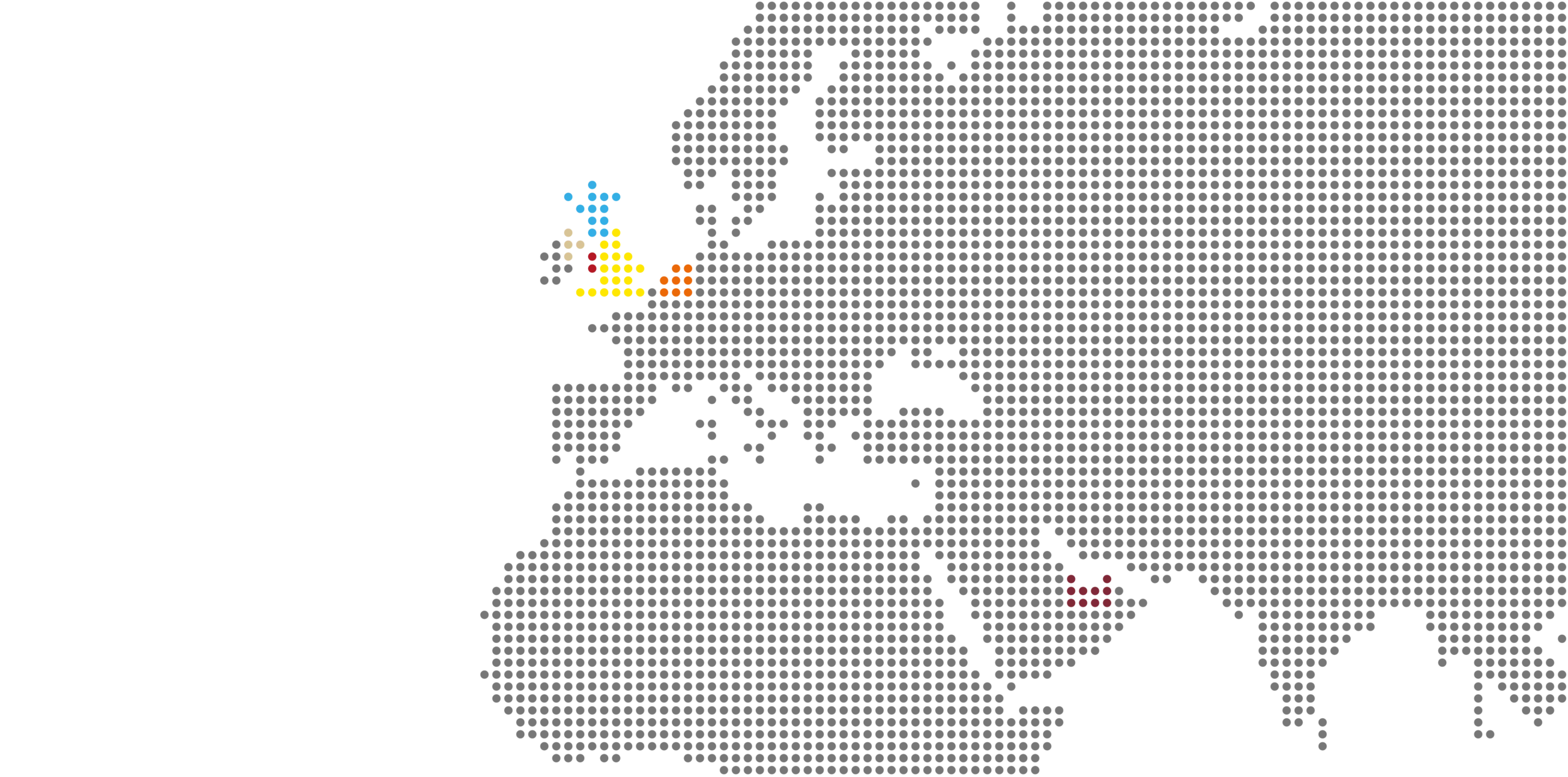

Regional Variations: Coastal regions face higher premiums due to storm and flood risks, while inland areas contend with wind and snow damage. Microclimates and climate change further complicate risk assessments, increasing the frequency of extreme weather events and driving insurance premiums higher.

Homeowner Strategies: Regular roof reinforcement, storm-resistant windows, and proper drainage systems can help mitigate damage. To file effective claims, homeowners should document damage thoroughly, report incidents promptly, and collaborate with adjusters.

Conclusion: Understanding Wales’s weather patterns and tailoring insurance policies accordingly is essential for homeowners to safeguard their properties. By combining proactive maintenance with comprehensive coverage, homeowners can mitigate risks and ensure fair compensation when weather-related damage occurs.

Wales experiences substantial rainfall throughout the year, making flooding a frequent concern for homeowners. Coastal regions and areas near rivers are particularly vulnerable. Flooding can cause extensive water damage, structural issues, and loss of personal belongings.

Windstorms are another common weather phenomenon in Wales, especially in coastal regions. High winds can damage roofs, break windows, and cause fallen trees, all of which can result in significant property damage and subsequent insurance claims.

While not as frequent, snow and ice can cause severe damage when they occur. Frozen pipes, roof collapse from snow load, and leaks are common issues during cold spells. Such weather events can lead to costly repairs and insurance claims.

Though less common, hailstorms can cause substantial damage to properties. Roofs, windows, and siding are particularly vulnerable. Filing a hail damage claim can be complex, but proper coverage can mitigate the financial burden.

Heavy rain and flooding often lead to water damage in homes. This can include anything from minor leaks to severe structural damage. Claims for water damage are among the most common in Wales.

Flooding can weaken a home’s foundation, leading to long-term structural problems. Repairing these issues is expensive, and insurance claims for foundation damage are not always straightforward.

Regions prone to flooding see a higher frequency of insurance claims. Homeowners in these areas must be particularly vigilant about maintaining adequate flood insurance coverage.

What Oakleafe Clients Say:

Windstorms can easily lift shingles or even entire sections of a roof, leading to leaks and structural issues. Roof damage claims are common after a windstorm.

High winds can shatter windows and cause trees to fall onto homes, resulting in significant damage. These events often necessitate emergency repairs and immediate insurance claims.

Homeowners must ensure their insurance policies include comprehensive wind damage coverage. This can significantly increase claim payouts.

Frozen pipes are a common issue during cold spells. When pipes burst, they can cause extensive water damage throughout a home, leading to costly repairs.

Heavy snowfall can add significant weight to roofs, leading to collapses and leaks. Proper maintenance and timely snow removal can help prevent such damage.

Claims for snow and ice damage can be challenging due to the need for precise documentation and proof of maintenance. Homeowners should be prepared with thorough records.

Hail can cause severe damage to roofs and windows, necessitating expensive repairs or replacements. These claims are often time-sensitive due to the potential for further damage from leaks.

Hail can dent or crack siding, affecting a home’s aesthetics and structural integrity. Siding damage claims can be complex, requiring detailed assessments.

Filing a claim for hail damage involves documenting the extent of the damage and obtaining repair estimates. Homeowners should be familiar with their policy’s coverage limits.

Coastal areas are more susceptible to severe storms and flooding, leading to higher claim frequencies. Due to this increased risk, properties in these regions often face higher insurance premiums.

Inland regions may experience fewer flooding incidents but can still be affected by windstorms and snowfall. Insurance claims in these areas often relate to wind and ice damage.

Wales’s varied topography creates microclimates that can affect local weather patterns. Understanding these nuances can help homeowners better prepare for specific risks.

Climate change is leading to more frequent and severe weather events in Wales, resulting in more weather-related property insurance claims.

Insurance companies adapt to these changes by reassessing risk profiles and adjusting premiums. Homeowners should stay informed about these trends to ensure adequate coverage.

With the increasing frequency of weather-related claims, insurance premiums are also rising. Homeowners may need to budget for higher insurance costs in the future.

Reinforcing roofs can help withstand high winds and heavy snowfall. Regular inspections and maintenance are crucial.

Installing storm-resistant windows can prevent breakage during storms and reduce the risk of water damage.

Maintaining proper drainage systems can help prevent flooding and water infiltration. Regular cleaning of gutters and downspouts is essential.

Documenting the extent of weather-related damage is the first step in filing a claim. Photos, videos, and detailed notes are essential.

Homeowners should contact their insurance company as soon as possible to report the damage and begin the claims process.

Working closely with insurance adjusters can help ensure that claims are processed smoothly and fairly.

Insurers assess weather risks to determine premiums. Higher-risk areas, like flood-prone regions, often face higher premiums.

A history of frequent claims can also lead to increased premiums. Homeowners should be aware of how their claim history affects their rates.

Insurance companies may adjust premiums based on evolving weather patterns and increased risks. Staying informed can help homeowners anticipate changes.

Examining real-life examples of weather-related property insurance claims can provide valuable insights. These case studies can highlight common challenges and successful claims resolutions.

Learning from successful claim resolutions can help homeowners understand the process and improve their claims.

Understanding the challenges faced in these claims can help homeowners better prepare and avoid common pitfalls.

Wales’s unique weather patterns significantly impact property insurance claims. Understanding these patterns and their effects can help homeowners protect their properties and ensure adequate insurance coverage. Being proactive in home maintenance, staying informed about insurance policies, and knowing how to file a claim are essential to managing weather-related risks.

By taking these steps, Welsh homeowners can mitigate the impact of severe weather and ensure prompt and fair compensation when damage occurs. For more information and personalised assistance, consider contacting a professional insurance advisor.

Oakleafe Claims have represented policyholders and managed their insurance claims since before the First World War. We have vast expertise and experience in both domestic and commercial insurance claims with thousands of satisfied policyholders who have received their deserved insurance settlement.

What Oakleafe Clients Say: